Why a Mobile-Friendly Website is a Must for Your E-commerce

Learn how a mobile-friendly E-Commerce website can skyrocket your sales, and enhance user experience, SEO & customer retention

Understanding taxes is crucial for any small business or e-commerce seller in India. Among the various taxes, Goods and Services Tax (GST) is very important. Knowing the different GST slabs and rates is essential for business growth and compliance.

This blog post will simply explain GST slabs and rates. Whether you're a new entrepreneur or an experienced online seller, this guide will help you understand the significance and impact of GST slabs on your business.

First, let's start with the basics - what is a GST slab? How do these slabs and rates affect your business operations and customer transactions?

If you haven't registered for GST yet, check out this blog on 'How to register for GST'

If you are a small business or if you are an e-commerce seller who is just starting out, click here to check out our latest article on understanding GST for beginners.

By the end, you'll have a clear knowledge of GST slabs and rates to help run your business smoothly while staying tax-compliant.

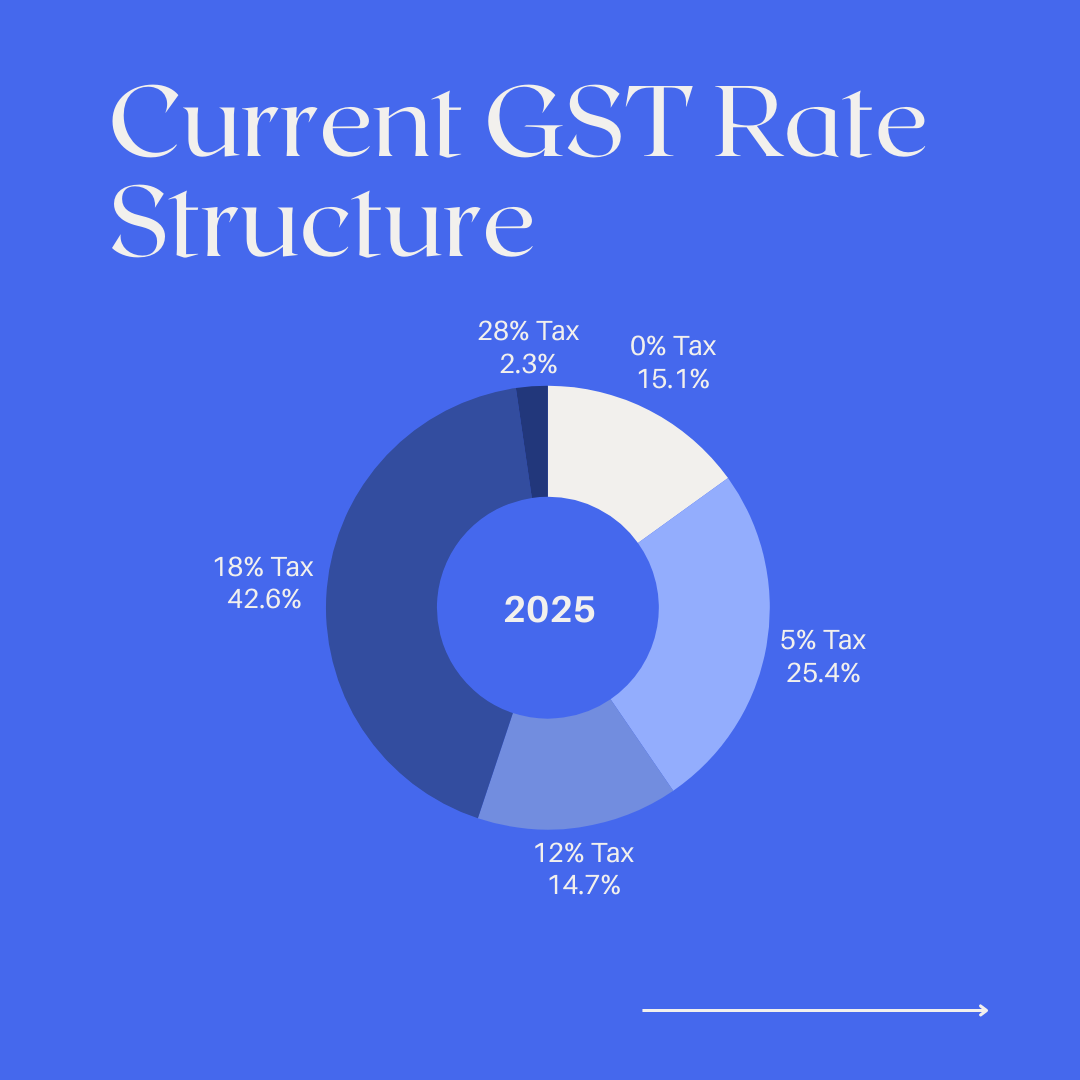

GST (Goods and Services Tax) rates are the tax percentages applied to the sale of goods or services in India. Knowing the correct GST rates is important for businesses and consumers.

The main GST rates are:

0% - (nil rate)

5% - Branded Cereals, edible oils, insulin, and footwear up to ₹ 1000

12% - Butter, Fats, Pasta, diabetic foods, mobile phones & bicycles

18% - Vinegar, paints, marbles & Plywood

28% - Cement, Auto parts, ACs, tobacco & aerated drinks

There are some special rates like 3% and 0.25% that apply in certain cases.

Composition taxpayers (small businesses) pay lower rates of 1.5%, 5%, or 6% on their turnover.

The rates are the same for both CGST (Central GST) and SGST (State GST) for transactions within a state. IGST (Integrated GST) is charged for interstate transactions, which is roughly the sum of CGST and SGST rates.

In addition to the GST rates, some products like cigarettes, aerated drinks, and cars attract a cess (additional tax) ranging from 1% to 204%.

The below link takes a deep dive into what the rates are for the various range of products.

You can either refer to this link https://cbic-gst.gov.in/gst-goods-services-rates.html or use this sheet to get to know the GST Slab

Here are the key points about GST simplified:

a. GST Registration: If your yearly sales cross a certain limit, you must register for GST within 30 days. Not registering can lead to penalties.

b. Filing Returns: Registered businesses have to file GST returns online every month, like GSTR-1 and GSTR-3B. Small businesses can file quarterly returns instead. There are also some annual filings based on turnover.

c. GST on Sales: When you sell goods/services, you need to charge GST at the applicable rate based on product codes. Pay this GST collected to the government monthly - CGST+SGST for within-state sales, IGST for other-state sales.

d. Input Tax Credit: You can claim credit for the GST you paid when you purchased goods/services for your business. This credit can reduce the GST you owe on sales. However, some purchases are not eligible for credit.

e. Reverse Charge: For certain services received, like legal or transportation, your business has to pay the GST instead of the supplier. This is called the Reverse Charge Mechanism.

In simple terms - register for GST if required, file periodic returns, pay GST on sales, claim credits on eligible purchases, and follow reverse charge rules when applicable.

Learn how a mobile-friendly E-Commerce website can skyrocket your sales, and enhance user experience, SEO & customer retention

Turn viewers into customers with video marketing. A beginner's guide to creating high-impact videos for your business

Discover the reasons for business failure & ensure your business's long-term success by avoiding them in your early stage